Year-End Payroll Advice for Small Business Owners

Tax season is nearly upon us. Year-end payroll can be a stressful time of year for many businesses. It is a time to prepare all the necessary paperwork for your tax accountant and get your finances in order as you prepare for a new year. It can be advantageous to work with a bookkeeper in anticipation of this crucial task if not only to provide you with the peace of mind that everything is in order. It is vital that you, as a business owner, understand which tasks are required in order to comply with not only the IRS but also the State and local governments, too. What is needed will depend on the structure of your business. Make sure you know exactly which forms and information you need whether you have employees or contract work out to other businesses.

Let’s take a look at some of the essential information and tasks, you, as an employer and business owner, will need to get in order before filing your taxes in 2021.

Confirm your EIN

It is imperative to ensure you have a verified Employer Identification Number when completing your year-end payroll. The bookkeeper or payroll processing company that you choose will require this from the outset. You can verify your EIN on the IRS website. They provide up to date information about how to obtain a new number and what to do if you lose it and need to apply for a new one. It is notable that it isn’t necessary to apply for a new number if you change the name or location of your business.

Verifying Employee Information

Updating and checking your payroll information before your year-end can save a lot of headaches. Confirm information such as social security numbers and names of all employees. So, what happens if an employee doesn’t have an SSN? You can advise them that they can apply for one with an “SS-5 application form for a Social Security Card”.

EMPLOYEES

(Image attribute: IRS website form templates)

W-4 Forms

The reason that it’s so important to ensure you’ve correct employee information is in order to submit the W-4. This is a required and necessary task all employers must complete for each employee. The W-4 or Employee’s Withholding Certificate lets you know exactly how much tax needs to be withheld based on circumstances such as marital status, allowances, and other deductions. As of 2020, the IRS has actually made this form a lot easier and more straightforward to fill out.

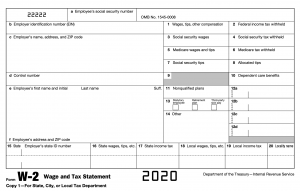

W-2 Forms

As stated by the IRS, any business that pays wages or salaries to employees and even non-cash payment up to six hundred dollars must guarantee that they submit the required W-2 forms. It is the employer’s sole responsibility to submit the form correctly and on time. Is your employee also a family member? Don’t forget that they will also require a W-2 form as well as anyone who has had their income, social security, or Medicare benefits withheld.

Internal Revenue Services are explicit about the onus being on the employer to make sure that the W-2 forms are submitted on time. For this reason, make it a priority to ensure that all of the information on each form is correct. This will mean not only verifying all employee information as detailed above but also double-checking and reviewing all information entered into your in-house database.

So, what happens if you submit your forms late? You could receive a fine which will increase the later your submission date. Not only that, if any of the information is incorrect, you can also be subject to penalties.

The deadline to submit all W-2 forms is the 31st of January 2021. It could be beneficial for you to hire a bookkeeper to ensure that everything is in order. The last thing you need is to be hit with hefty penalties that could have been so easily avoided.

INDEPENDENT CONTRACTORS

(Image attribute: IRS website form templates)

W-9 Forms

Although the W-4 and W-9 forms are similar, there are some significant differences that all employers should know.

The W-9 form is for all independent contractors that you have hired and paid above six hundred dollars to, in the tax year. A contractor or non-employee must provide a Tax Identification Number (TIN) which will be their Employer Identification Number (EIN) or a Social Security Number if they are registered as an individual (Sole Proprietor or Freelancer). Additionally, they’ll need to certify that the information they have provided is correct and that they are a legal US citizen.

Make sure to provide them with all information that you need and also a deadline to submit to you, so that you don’t incur any issues. The most notable sections on the W-9 are TIN declaration and certification.

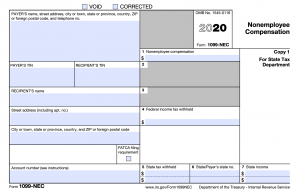

Introduction of 1099-NEC

Before this year, all independent contractor payments were reported and declared using a 1099MISC form. As of 2020, all employers are now obligated to separate all payments made to non-employees with a 1099-NEC form (non-employee compensation).

Your 1099-NEC cannot be filed until each non-employee has submitted a W-9 form to you. Once they have, you can then proceed with filling out your 1099-NEC form which will include information such as the total compensation amount (anything over six hundred dollars must be declared) and also both of your TIN or EIN numbers.

The deadline to submit all 1099 forms is the 31st January 2021, and just like the W-2 forms, there will be penalties for late submissions and the submission of incorrect information.

Know Your State’s Requirements

Each state will have different rules and guidelines that need to be followed. Make sure to verify state numbers and check with the state and local regulations for W-2 and 1099 filing requirements. It is notable that most states participate in shared information with the IRS. This means that when you submit to the IRS you are also submitting to your state.

Most of my clients are based in Colorado, here is a useful link that I often share with them regarding the state’s requirements.

Take-aways

Running a business can sometimes feel like a never-ending to-do list. Filing taxes is something that most of us aren’t excited to do and often will leave us feeling stressed. Having a system in place such as an ongoing payroll service can make January 2021 a lot easier, which means that you can focus on the areas of your business that need you the most.

Don’t have the time or energy to focus on bookkeeping or payroll services? Outsourcing these time consuming but necessary tasks could be the answer. To find out more about how I can help your business, check out my services page and feel free to get in touch.